Standard Deduction 2025 Married Filing Joint Declaration

Standard Deduction 2025 Married Filing Joint Declaration. For the 2023 tax year (for forms you file in 2025), the standard deduction is $13,850 for single filers and married couples filing separately, $27,700 for married. Each year, the irs adjusts the standard deduction, tax brackets, and other tax breaks to compensate for inflation.

You can choose married filing jointly as your filing status if you are considered married and both you and your spouse agree to file a joint return. So as long as you got your marriage license in 2023, you were.

Projected 2025 Amt Exemption Amount By Filing Status.

Each year, the irs adjusts the standard deduction, tax brackets, and other tax breaks to compensate for inflation.

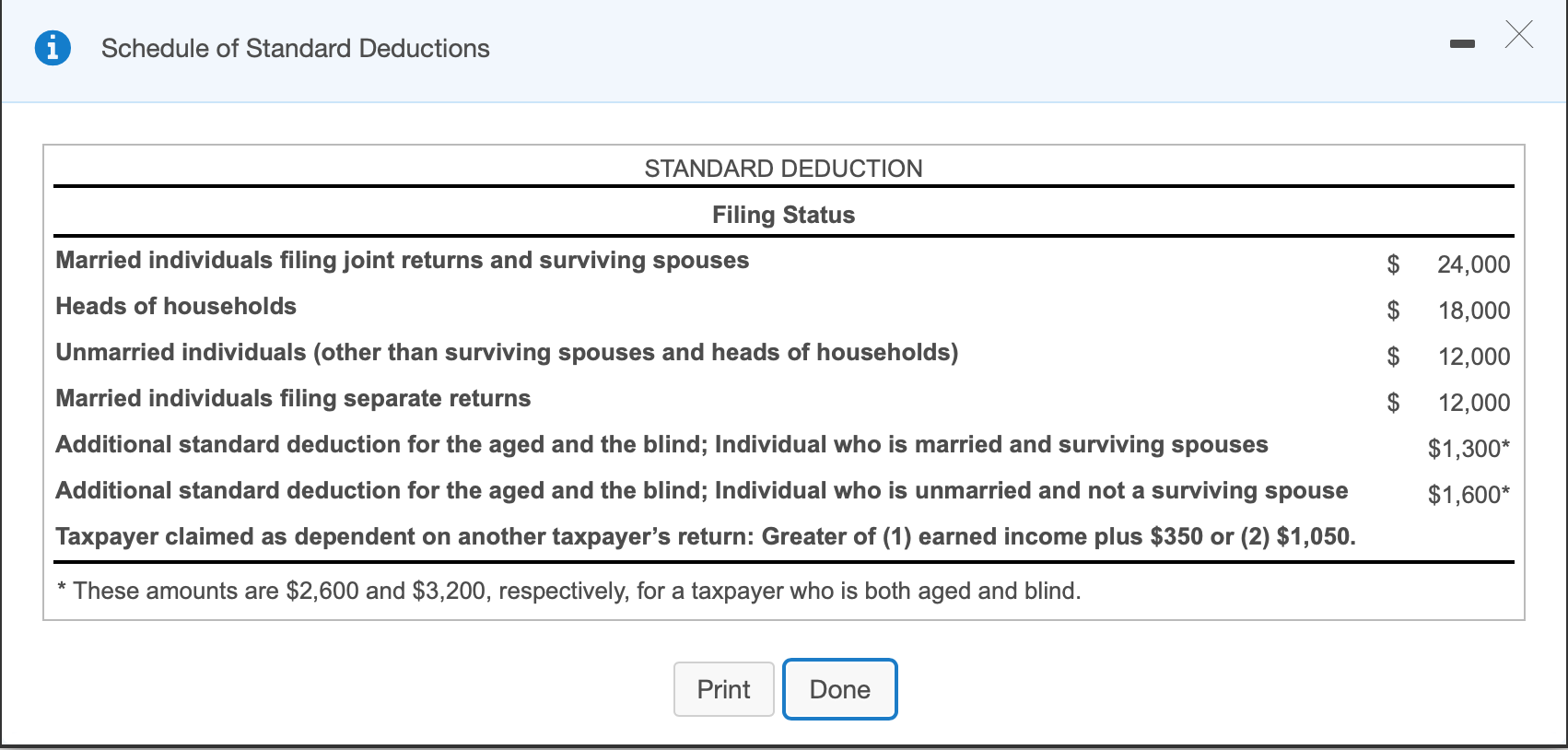

The Deduction Set By The Irs For The 2025 Tax Year Is As Follows:

So as long as you got your marriage license in 2023, you were.

You Can Choose Married Filing Jointly As Your Filing Status If You Are Considered Married And Both You And Your Spouse Agree To File A Joint Return.

Images References :

Source: isadorawamara.pages.dev

Source: isadorawamara.pages.dev

Tax Brackets 2025 Usa Married Filing Jointly Reyna Clemmie, For the tax year 2025, married couples filing jointly (those who are legally married and choose to file their taxes together) are eligible for a standard deduction of. $14,600 for single filers $14,600 for married couples filing separately $21,900 for heads of households $29,200.

Source: dacieqangelle.pages.dev

Source: dacieqangelle.pages.dev

2025 Tax Brackets Married Filing Separately 2025 Dalila Magdalene, You can choose married filing jointly as your filing status if you are considered married and both you and your spouse agree to file a joint return. Unmarried individuals (other than surviving.

Source: jocelinwdawn.pages.dev

Source: jocelinwdawn.pages.dev

Tax Brackets 2025 Married Jointly Irs Deeyn Evelina, The standard deduction for married couples filing jointly for tax year 2025 will rise to $29,200, an increase of $1,500 from tax year 2023. Key highlights of the standard deduction for married filing jointly in 2023 and 2025 include:

Source: sissiewjohna.pages.dev

Source: sissiewjohna.pages.dev

2025 Tax Brackets Married Jointly Single Patsy Gennifer, You can choose married filing jointly as your filing status if you are considered married and both you and your spouse agree to file a joint return. The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2).

Source: madlenwroxie.pages.dev

Source: madlenwroxie.pages.dev

Standard Deduction Mfj 2025 Dode Nadean, Taxpayers who are considering the standard deduction or itemized deductions for their tax return; The additional standard deduction for age 65 is larger in the single filing status than the additional standard deduction per person for age 65 in married filing.

Source: charleanwgerry.pages.dev

Source: charleanwgerry.pages.dev

2025 Married Filing Jointly Tax Brackets Golda Gloriane, For the tax year 2025, married couples filing jointly (those who are legally married and choose to file their taxes together) are eligible for a standard deduction of. For the 2023 tax year, the standard deduction for married couples filing jointly is $27,700, nearly double the $13,850 deduction for those filing separately.

Source: conchitawarden.pages.dev

Source: conchitawarden.pages.dev

Tax Table 2025 Married Filing Jointly Laura, Last week, they released their numbers for tax. Married and filing jointly typically can net you a bigger standard deduction, reducing your taxable income—$27,700 for most couples.

Source: bobbyeqestrella.pages.dev

Source: bobbyeqestrella.pages.dev

What Are The 2025 Tax Brackets For Married Filing Jointly Issi Charisse, Taxpayers who are considering the standard deduction or itemized deductions for their tax return; That’s the 2025 regular standard deduction of $29,200 for married taxpayers filing joint returns, plus three additional standard deductions at $1,550 apiece.

Source: amalieqchristye.pages.dev

Source: amalieqchristye.pages.dev

2025 Federal Standard Deduction For Married Filing Jointly Merla Stephie, Last week, they released their numbers for tax. The standard deduction for single filers and for married people who file separate returns rises to $14,600, up $750 from 2023;

Source: felipaqchristabel.pages.dev

Source: felipaqchristabel.pages.dev

Standard Federal Tax Deduction For 2025 Cati Mattie, Each year, the irs adjusts the standard deduction, tax brackets, and other tax breaks to compensate for inflation. That’s the 2025 regular standard deduction of $29,200 for married taxpayers filing joint returns, plus three additional standard deductions at $1,550 apiece.

For The 2023 Tax Year (For Forms You File In 2025), The Standard Deduction Is $13,850 For Single Filers And Married Couples Filing Separately, $27,700 For Married.

Taxpayers who are considering the standard deduction or itemized deductions for their tax return;

In Order To File A Joint Tax Return In 2025, You Had To Have Been Legally Married By Dec.

For the 2023 tax year, the standard deduction for married couples filing jointly is $27,700, nearly double the $13,850 deduction for those filing separately.