2024 Fsa Carryover Amount

2024 Fsa Carryover Amount. For plans that allow a carryover of unused funds, the maximum amount of 2024 contributions that can roll over into 2025 is $640, a $30 increase over the 2023 rollover amount. 2024 commuter benefits contribution limits.

For unused amounts in 2023, the maximum amount that can be carried over to 2024 is $610. Reimbursed from any remaining 2024 balance.

(For The 2024 Plan Year, That.

Increases to $3,200 in 2024 (up $150 from $3,050 in 2023) fsa carryover limit:

The Irs Permits Employers To Allow Their Employees To Carry Over Up To $610 From Their 2023 Fsa (Indexed Annually, Per Irs Rules).

If you don’t use all your fsa funds by the end of the plan year, you may be able to carry over $640 to 2025.

When It Comes To Unused Funds In 2023, The Maximum Amount That Can Be Carried Over Into 2024 Is $610.

Images References :

Source: vevayapatrizia.pages.dev

Source: vevayapatrizia.pages.dev

2024 Fsa Maximum Limits Randa Carolyne, When it comes to unused funds in 2023, the maximum amount that can be carried over into 2024 is $610. It’s important for taxpayers to annually review their health care selections during health care open enrollment season and maximize their.

Source: piercegroupbenefits.com

Source: piercegroupbenefits.com

IRS Announces 2024 Limits for Health FSA Contributions and Carryovers, For fsas that permit the carryover of unused amounts, the maximum 2024 carryover amount to 2025 is $640. 2024 commuter benefits contribution limits.

Source: imagetou.com

Source: imagetou.com

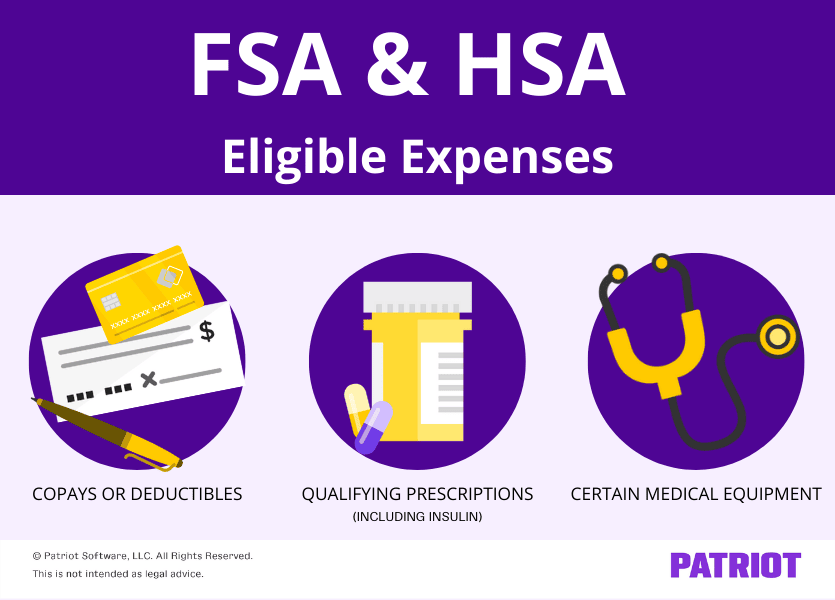

Fsa Approved Items 2024 Image to u, Annual hsa contribution limit for individuals. 2024 medical fsa contribution limits (including limited and combination fsas) 2023:

Source: vevayapatrizia.pages.dev

Source: vevayapatrizia.pages.dev

2024 Fsa Maximum Limits Randa Carolyne, Eligible participants, as a result, can contribute up to a total of $30,500 for their retirement plan in 2024. The internal revenue service has upped the contribution limit on flexible spending accounts to $3,050, allowing 20% of that amount, or $610, to carry over from 2023 into 2024.

Source: www.differencecard.com

Source: www.differencecard.com

The IRS 2023 Cost of Living Adjustments Changes in 2023, Among the changes employers can make is to allow up to the full election amount for both of these accounts to carryover from 2020 to 2021 and 2021 to 2022, for instance. The carryover feature typically allows you to roll over up to 20% of the maximum fsa contribution every year, if your employer allows it.

.png) Source: koreqshelley.pages.dev

Source: koreqshelley.pages.dev

Has Irs Announced Fsa Limits For 2024 Jany Blancha, In 2024, you can carry. It's important for taxpayers to annually review their.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

HSA vs. FSA What's the Difference? 2024 Contribution Limits, These limits undergo annual adjustments to account for inflation. For fsas that permit the carryover of unused amounts, the maximum 2024 carryover amount to 2025 is $640.

Source: www.edvisors.com

Source: www.edvisors.com

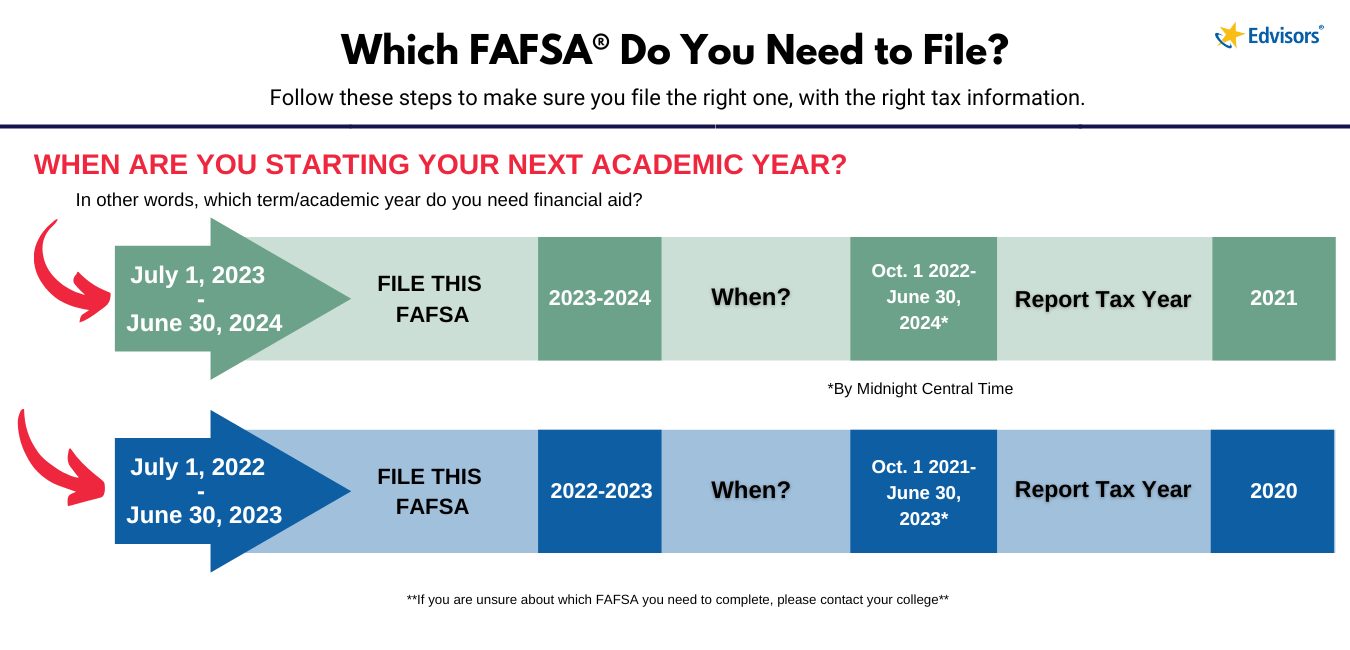

When is the FAFSA Deadline 20232024? Edvisors, These limits undergo annual adjustments to account for inflation. For fsas that permit the carryover of unused amounts, the maximum 2024 carryover amount to 2025 is $640.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Healthcare and Limited Purpose FSA Carryover PowerPoint, That figure remains the same from this year. 2024 medical fsa contribution limits (including limited and combination fsas) 2023:

2024 Fsa Maximums Orly Pansie, The significance of the 2024 fsa changes. How do i know if my employer’s fsa plan has the carryover feature?

It's Important For Taxpayers To Annually Review Their.

Under irs guidance issued in may 2020, plan sponsors could allow health and dependent care fsa participants to make midyear contribution changes and increased the carryover limit permitted for.

For 2024, The Maximum Carryover Rule Is $640 In Carryover Funds (20% Of The $3,200 Maximum Fsa Contribution).

If you don’t use all your fsa funds by the end of the plan year, you may be able to carry over $640 to 2025.